Marie checks her electricity bill twice, squinting at the numbers that seem to climb higher each month. Like millions across Europe, she’s watching her energy costs spiral while wondering who really controls the power flowing into her home. What she doesn’t realize is that a massive shift is happening behind the scenes—one that could reshape how Europe generates and distributes electricity for decades to come.

The French energy giant TotalEnergies just pulled off one of the biggest power sector deals in recent memory. Their €5.1 billion takeover of Czech energy group EPH isn’t just another corporate acquisition—it’s creating a new European energy powerhouse that puts French interests at the center of the continent’s electricity future.

This TotalEnergies European energy takeover marks a pivotal moment. It signals how major players are positioning themselves as Europe races to secure reliable power supplies while transitioning away from traditional fossil fuels.

The Deal That’s Redrawing Europe’s Energy Map

TotalEnergies didn’t just buy a company—they absorbed an entire energy ecosystem. The €5.1 billion all-share deal gives them a 50% stake in EPH’s vast “flexible power” platform, which includes gas-fired plants, biomass units, and industrial-scale batteries scattered across Western Europe.

Here’s what makes this deal fascinating: TotalEnergies paid entirely with their own shares, meaning no cash changed hands. Instead, they issued 95.4 million new shares at €53.94 each to EPH’s owners. This clever financial engineering means TotalEnergies keeps their cash reserves intact while EPH suddenly becomes a major shareholder with roughly 4.1% of the French giant’s capital.

“This transaction fundamentally changes the competitive landscape in European power generation,” notes energy analyst Thomas Dubois. “TotalEnergies is essentially buying their way into the electricity backbone of multiple European countries.”

The assets EPH brings to the table are valued at around €10.6 billion, making this deal incredibly strategic for TotalEnergies’ transformation from an oil-and-gas supermajor into what they call a “multi-energy” company.

What TotalEnergies Actually Gets From This Massive Investment

The scope of this TotalEnergies European energy takeover becomes clearer when you see exactly what assets are changing hands. EPH built their empire by snapping up power plants and infrastructure that other companies were eager to sell off during Europe’s energy transition.

Key assets in the deal include:

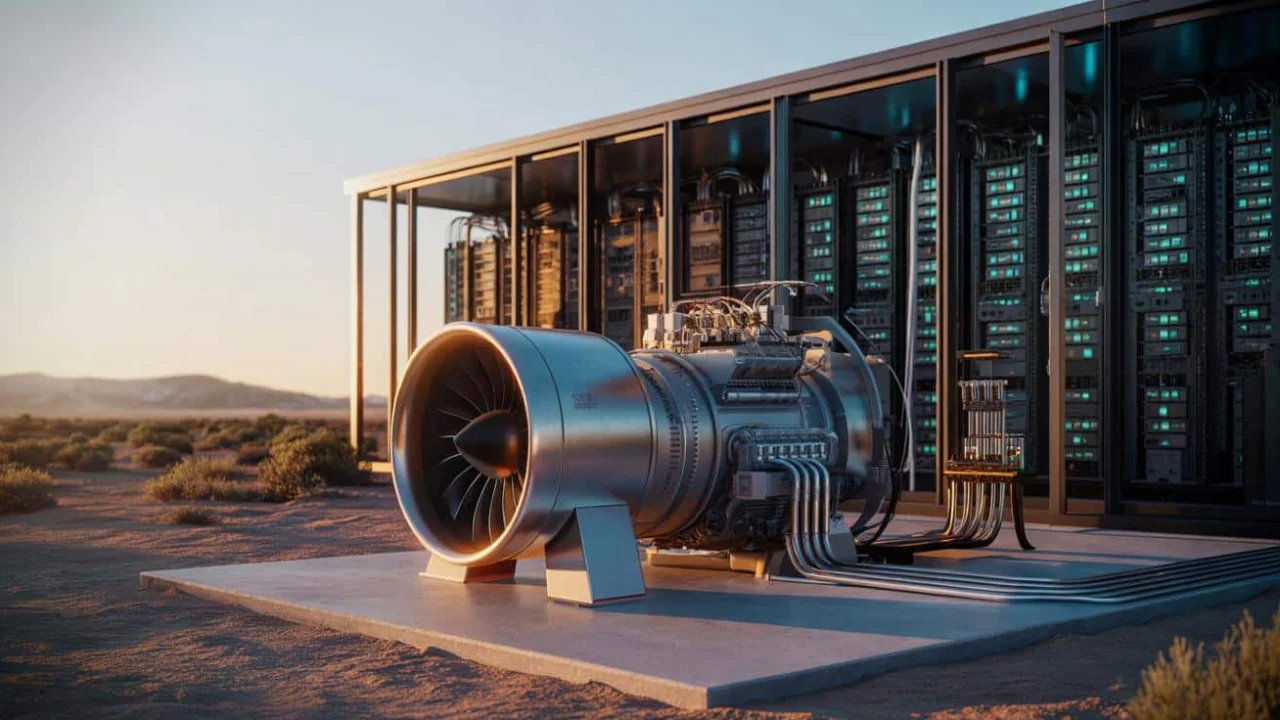

- Multiple gas-fired power plants across Western Europe capable of rapid electricity generation

- Biomass facilities that burn organic materials for renewable energy production

- Industrial-scale battery storage systems crucial for grid stability

- Cogeneration plants that produce both electricity and useful heat

- Critical gas transport infrastructure connecting multiple European markets

| Asset Type | Strategic Value | Geographic Coverage |

|---|---|---|

| Gas-fired Plants | Flexible backup power | Germany, UK, Italy |

| Battery Storage | Grid stabilization | Multiple EU markets |

| Biomass Units | Renewable baseload | Central Europe |

| Gas Infrastructure | Supply chain control | Slovakia, Czech Republic |

“EPH essentially built a portfolio of assets that nobody else wanted, but which are now incredibly valuable for grid flexibility,” explains energy economist Sarah Mitchell. “TotalEnergies is getting access to the exact type of infrastructure needed to balance renewable energy intermittency.”

The Czech Opportunists Who Built an Energy Empire

To understand why this takeover matters so much, you need to know EPH’s remarkable story. Founded in 2009 by Czech-Slovak investment groups, Energetický a průmyslový holding made their fortune by buying assets that traditional utilities were desperate to unload.

While established energy companies were selling off coal plants and aging gas infrastructure to focus on renewables, EPH saw opportunity. They bought these “transitional” assets at steep discounts, restructured operations, and often ran them at full capacity to maximize short-term profits.

EPH’s strategy proved incredibly prescient. As Europe faced energy security crises and renewable intermittency challenges, these flexible power assets became essential grid infrastructure. What looked like stranded assets in 2010 became critical backup power by 2020.

“EPH basically bet against the consensus that these thermal assets would become worthless,” notes Prague-based energy consultant Viktor Novak. “Now TotalEnergies is paying premium prices for exactly those assets.”

How This Changes Your Energy Future

For ordinary Europeans like Marie checking their electricity bills, this TotalEnergies European energy takeover could have real consequences. The deal creates a new energy giant with significant influence over power supply and pricing across multiple European markets.

TotalEnergies now controls flexible power generation that can quickly ramp up when wind doesn’t blow or solar panels don’t produce enough electricity. This gives them substantial leverage in wholesale electricity markets, potentially affecting the prices that eventually reach consumer bills.

The timing is particularly significant. Europe is struggling to balance three conflicting priorities: ensuring energy security, maintaining affordable prices, and achieving climate goals. TotalEnergies’ new portfolio positions them as a key player in managing these trade-offs.

Regional governments are watching closely too. Having critical power infrastructure controlled by a single French company raises questions about energy sovereignty, especially for smaller European nations that could become more dependent on TotalEnergies’ generation capacity.

“This consolidation trend means fewer companies controlling more of Europe’s power supply,” warns energy policy expert Dr. Andreas Weber. “That’s great for efficiency but potentially problematic for competition and pricing.”

The deal also accelerates TotalEnergies’ pivot away from oil and gas toward electricity and renewable energy. Their massive investment signals confidence that power generation will be more profitable than traditional hydrocarbon production in the coming decades.

FAQs

Why did TotalEnergies pay €5.1 billion in shares rather than cash?

Paying in shares allows TotalEnergies to keep their cash reserves intact while making EPH a major shareholder with aligned interests in the combined company’s success.

What makes EPH’s power plants so valuable to TotalEnergies?

These flexible power assets can quickly respond to electricity demand changes, making them crucial for grid stability as Europe relies more on intermittent renewable energy sources.

Will this deal affect electricity prices for consumers?

Potentially yes, as TotalEnergies now controls more flexible power generation capacity that influences wholesale electricity pricing across multiple European markets.

How does this change TotalEnergies’ business model?

The deal accelerates their transformation from a traditional oil and gas company into a diversified energy provider focused on electricity generation and renewable power.

What regulatory approvals does this deal need?

The transaction requires approval from European competition authorities, who will examine whether the combined company creates excessive market concentration in any specific regions.

Could other energy companies follow TotalEnergies’ strategy?

Likely yes, as this deal demonstrates how acquiring flexible power assets can provide strategic advantages in Europe’s evolving energy landscape.