Sarah Chen stared at her laptop screen in frustration. Her company’s latest AI model kept crashing during training runs, and the custom chips they’d ordered were delayed again. “Supply chain issues,” the vendor explained vaguely. What Sarah didn’t know was that her high-performance computing dreams hinged on a tiny film made by the same company that seasons her instant ramen.

This scenario plays out daily across tech companies worldwide. Behind every ChatGPT query, every autonomous vehicle decision, and every smartphone photo enhancement lies a critical material most people have never heard of. It’s a story that connects century-old food chemistry to the cutting edge of artificial intelligence.

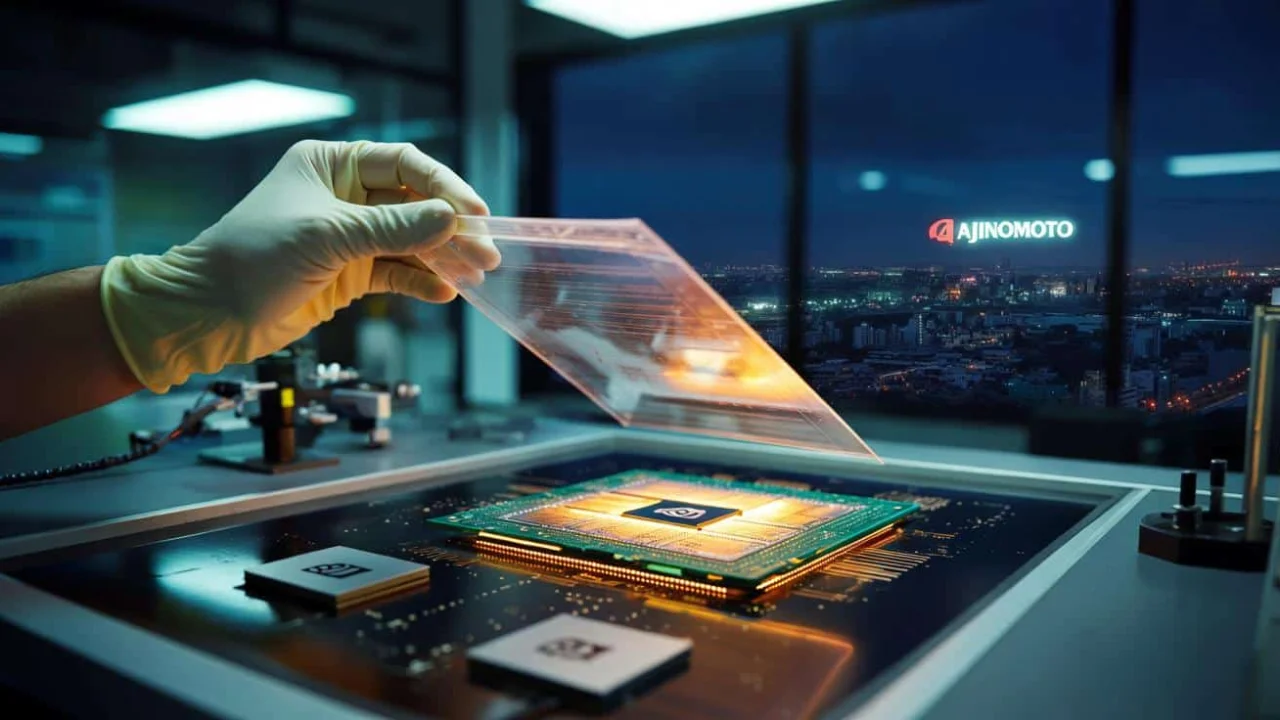

Welcome to the hidden world of Ajinomoto Build-up Film – a material so specialized that one Japanese food giant controls 95% of global supply, yet so essential that billion-dollar chip factories can’t operate without it.

The Invisible Foundation of Modern Computing

Ajinomoto Build-up Film, known in the industry simply as ABF, represents one of the most critical chokepoints in global technology manufacturing. This ultra-thin insulating material gets sandwiched between layers of semiconductor substrates, creating the foundation that holds together every advanced processor chip.

“Without ABF, you simply cannot build the high-performance chips that power modern AI systems,” explains Dr. Michael Rodriguez, a semiconductor packaging expert. “It’s like trying to build a skyscraper without steel reinforcement – technically impossible at today’s performance levels.”

The material solves a fundamental physics problem. As chip designers pack more transistors and connections into smaller spaces, they create intense heat and electrical interference. Traditional materials would warp, short-circuit, or simply melt under these conditions. Ajinomoto Build-up Film maintains structural integrity while providing precise electrical insulation, even in the most demanding applications.

What makes this situation remarkable is the company behind it. For most consumers, Ajinomoto means MSG seasoning and instant soup packets. The company generates billions in revenue from food products sold in grocery stores across Asia and beyond. Yet hidden within this consumer goods empire sits a high-tech materials division that has become indispensable to global chipmaking.

Key Facts About This Critical Material

Understanding the scope and importance of Ajinomoto Build-up Film requires looking at the numbers and technical specifications that make it irreplaceable:

- Market Dominance: Ajinomoto controls approximately 95% of global ABF production

- Critical Applications: Used in all major CPU and GPU packaging from Nvidia, AMD, Intel, and others

- Technical Specifications: Provides insulation layers as thin as 10-15 micrometers

- Temperature Resistance: Maintains stability at temperatures exceeding 260°C during manufacturing

- Supply Chain Impact: Any disruption affects semiconductor production across Taiwan, South Korea, and the United States

| Specification | Value | Industry Impact |

|---|---|---|

| Global Market Share | 95% | Near-monopoly control |

| Layer Thickness | 10-15 micrometers | Enables high-density packaging |

| Operating Temperature | 260°C+ | Withstands manufacturing processes |

| Key Customers | TSMC, Samsung, Intel | Powers all major chip foundries |

The technical requirements for ABF are extraordinarily demanding. The material must remain dimensionally stable while being heated, cooled, and subjected to chemical processes during chip manufacturing. It needs precise electrical properties to prevent signal interference while allowing thousands of connections to pass through microscopic spaces.

“The tolerances are incredible,” notes Lisa Park, a materials engineer who has worked with major chip manufacturers. “We’re talking about maintaining consistent properties across films thinner than human hair, with zero defects across entire production runs.”

From Seaweed Soup to Silicon Substrates

The journey from food seasoning to semiconductor materials began with a simple observation in 1908. Japanese scientist Kikunae Ikeda noticed that his wife’s seaweed broth had a distinctive savory taste that didn’t fit the traditional categories of sweet, sour, bitter, or salty. His investigation led to the identification of glutamate and the discovery of umami – what we now recognize as the fifth taste.

Ikeda founded Ajinomoto in 1909, meaning “the essence of taste” in Japanese. The company built its early success on MSG production and other food additives. But the real breakthrough came from an unexpected source: chemical waste.

During the 1970s, Ajinomoto’s amino acid manufacturing created substantial chemical byproducts. Rather than treating these as waste, company researchers began exploring alternative applications. Their expertise in fermentation chemistry and polymer science led them into industrial materials development.

The transition into electronics materials happened gradually. Ajinomoto researchers discovered that their chemical processing knowledge could create specialized polymers for emerging technology applications. By the 1990s, as semiconductor packaging became more sophisticated, they had developed the first versions of what would become ABF.

“It’s a classic example of innovation through necessity,” explains Dr. James Liu, who studies technology supply chains. “They had the chemistry expertise and waste stream management challenges that led them to discover applications no pure-play materials company was pursuing.”

Real-World Impact Across Industries

The dominance of Ajinomoto Build-up Film creates ripple effects throughout the global technology ecosystem. When Ajinomoto faces production issues, delays, or capacity constraints, the entire semiconductor industry feels the impact within weeks.

Major chip foundries like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung maintain careful relationships with Ajinomoto to ensure steady ABF supplies. Any disruption can halt production of the most advanced processors, affecting everything from gaming graphics cards to data center servers running AI workloads.

The automotive industry represents another critical dependency. Modern electric vehicles and autonomous driving systems rely on high-performance chips that require ABF substrates. A shortage of this material can delay vehicle production lines and slow the adoption of new automotive technologies.

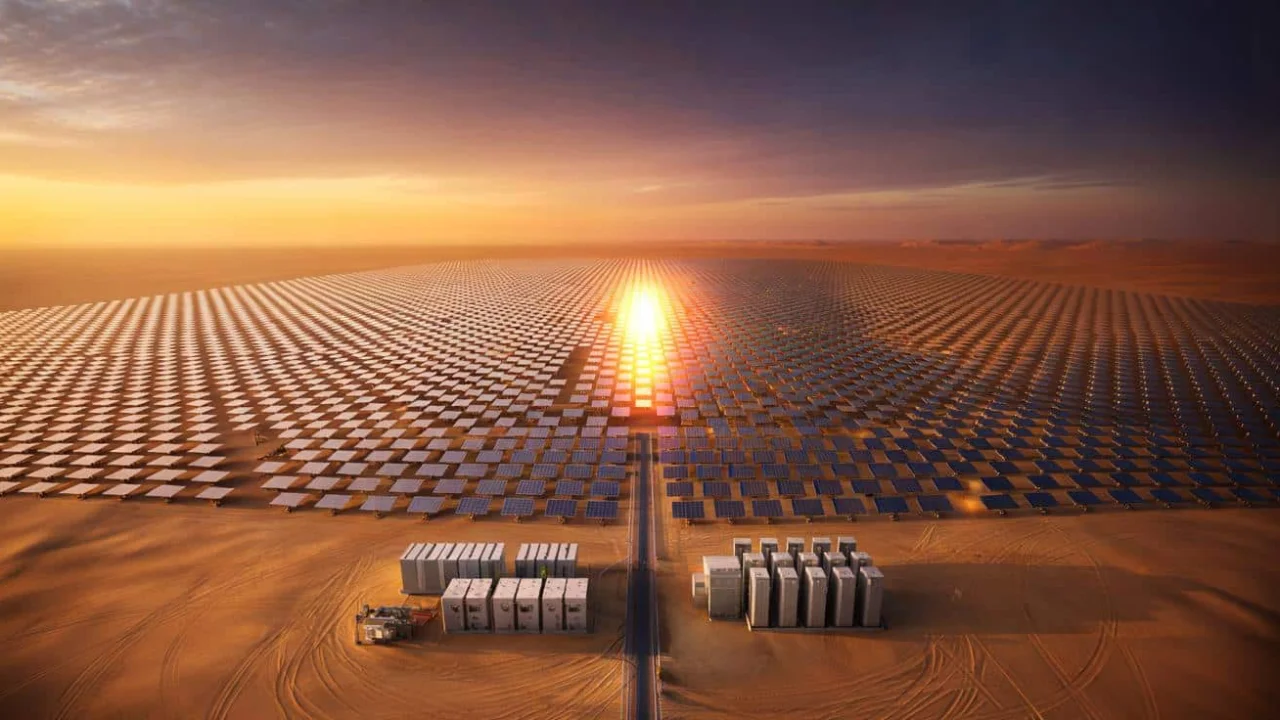

Data centers powering cloud computing and artificial intelligence training represent perhaps the highest-stakes application. Companies like Google, Microsoft, and OpenAI depend on specialized AI chips that cannot be manufactured without Ajinomoto’s materials. Training large language models requires thousands of these processors working in coordination.

“When you use ChatGPT or any AI application, you’re ultimately depending on this one company’s ability to produce a specialized film,” observes Dr. Sarah Kim, who researches technology supply chain vulnerabilities. “It’s a single point of failure that most people never think about.”

The geopolitical implications are significant. As countries compete to develop domestic semiconductor manufacturing capabilities, they discover that critical materials like ABF remain concentrated in specific suppliers. This creates strategic dependencies that governments are only beginning to understand and address.

Consumer electronics manufacturers also face constraints. Smartphone processors, gaming consoles, and laptop CPUs all require substrates built with Ajinomoto Build-up Film. Product launch schedules for major technology companies can be affected by ABF availability and pricing.

FAQs

What exactly is Ajinomoto Build-up Film?

It’s a ultra-thin insulating material used in semiconductor packaging that prevents electrical interference while allowing thousands of connections in a tiny space.

Why does one company control 95% of the market?

Ajinomoto developed the material through decades of chemical research and built specialized manufacturing capabilities that are extremely difficult to replicate.

Which companies depend on this material?

All major chip manufacturers including Nvidia, AMD, Intel, and foundries like TSMC and Samsung require ABF for their most advanced processors.

What happens if supply is disrupted?

Semiconductor production would face immediate constraints, affecting everything from AI chips to smartphone processors and automotive electronics.

Are there alternatives to ABF?

Currently no other material matches ABF’s performance characteristics for high-end semiconductor packaging, though research continues into potential substitutes.

How did a food company end up making semiconductor materials?

Ajinomoto’s expertise in chemistry and fermentation, combined with creative use of manufacturing byproducts, led them to discover applications in electronics materials during the 1970s and 1980s.