Marie Dubois still remembers the day the factory floor went quiet. It was 2019, and the Arabelle turbine plant in Belfort had just lost another major contract to Asian competitors. Workers shuffled past empty assembly bays where massive steam turbines once took shape, wondering if their decades of expertise would become obsolete.

Today, that same factory is buzzing with activity again. The reason? A €1 billion contract from Poland that’s breathing new life into Europe’s nuclear supply chain and proving that French industrial know-how isn’t finished yet.

This isn’t just another business deal. It’s a signal that the global nuclear renaissance might finally have room for European suppliers, and that the nuclear supply chain many thought was dying could be staging one of the most remarkable comebacks in industrial history.

Poland’s Nuclear Gamble Changes Everything

For over seventy years, Poland burned coal like there was no tomorrow. In 2022, more than 70% of the country’s electricity came from coal and lignite plants that dotted the landscape like industrial monuments to a bygone era.

But that’s changing fast. By mid-2025, coal’s share dropped below 50% for the first time, squeezed out by natural gas, renewables, and carbon costs that made burning coal increasingly expensive.

Now Poland is making its biggest energy bet in generations. In January 2026, Warsaw confirmed construction of its first commercial nuclear power plant at Lubiatowo, right on the Baltic Sea coast. The facility will house three AP1000 reactors designed by American company Westinghouse.

“This represents the largest shift in Poland’s energy strategy since the fall of communism,” says energy analyst Dr. Klaus Weber. “They’re not just replacing coal – they’re completely reimagining their energy future.”

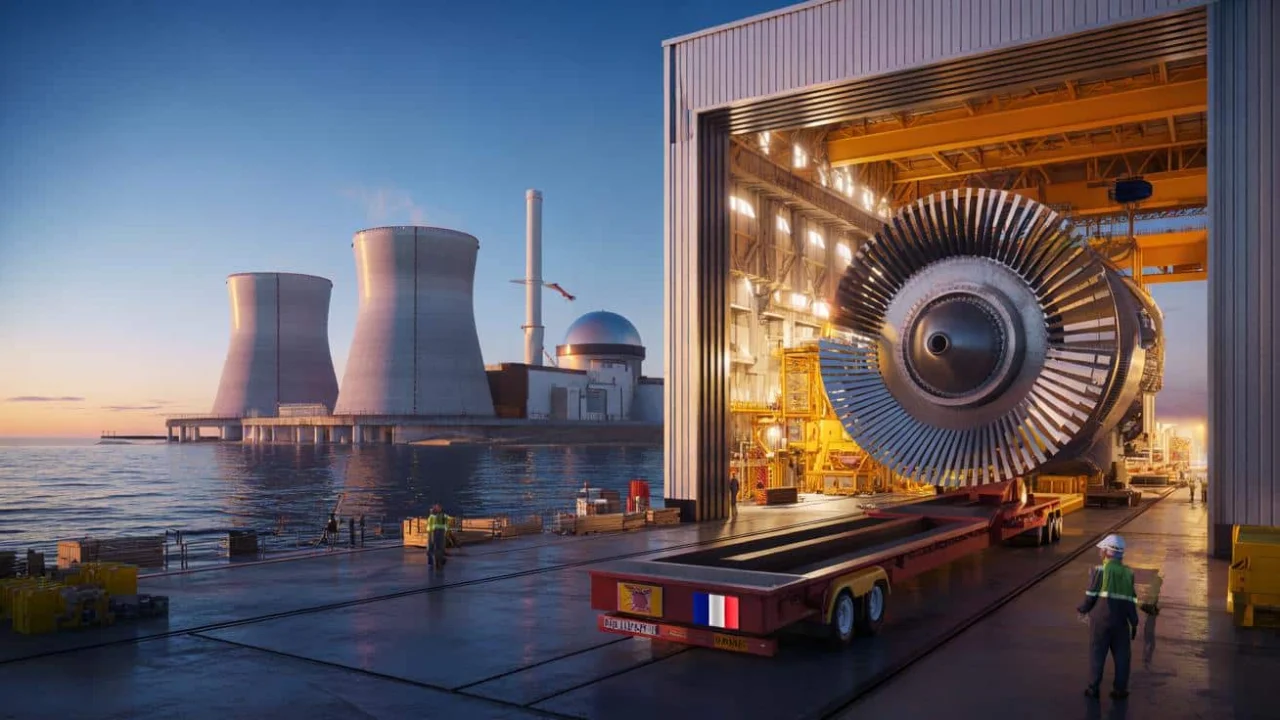

Here’s where the story gets interesting for France. While American nuclear technology will power the reactors, the machines that actually turn that heat into electricity will be built in Belfort, France, by Arabelle Solutions.

The Billion-Euro Contract That’s Saving French Industry

The numbers behind this deal are staggering. Arabelle Solutions will provide three massive steam turbines, each capable of generating around 1,200 megawatts of electrical output. Together, they’ll supply enough electricity for several million homes once all three units come online from 2033 onwards.

While no official price has been announced, industry experts estimate the contract’s value between €1 billion and €2 billion, with most analysts settling around €1.5 billion for the complete turbine package.

| Component | Specification | Estimated Value |

|---|---|---|

| Steam Turbines (3 units) | 1,200 MW each | €900M – €1.2B |

| Generators | High-efficiency design | €300M – €400M |

| Condensers & Auxiliaries | Full island package | €200M – €300M |

| Engineering & Installation | Complete integration | €100M – €200M |

“Each turbine island for a large reactor now costs between €400 million and €600 million,” explains nuclear industry consultant Sarah Chen. “The safety requirements and engineering complexity have increased dramatically over the past decade.”

But this contract goes far beyond just turbines. Arabelle’s scope includes the entire steam turbine island: condensers that cool the steam back to water, generators that convert mechanical rotation into electricity, auxiliary systems that keep everything running smoothly, and the complex interfaces that connect the conventional plant to the nuclear reactor.

The deal represents a complete turnaround for the European nuclear supply chain, which had been losing ground to competitors in Asia and North America for years.

Why This Win Matters for Europe’s Energy Future

This contract isn’t just good news for one French factory – it’s a lifeline for Europe’s entire nuclear supply chain. For years, European companies watched helplessly as projects went to cheaper Asian manufacturers or American firms with better government backing.

The Arabelle win proves that European expertise still has value in the global nuclear market. The company’s turbines are known for their reliability and efficiency, qualities that matter more than ever as nuclear plants need to operate safely for 60 years or more.

“This contract validates our belief that quality and long-term reliability trump short-term cost savings,” says former nuclear engineer Philippe Montclair. “Nuclear plants are not smartphones – you can’t replace them every few years.”

The ripple effects extend throughout France’s industrial ecosystem:

- Over 1,000 direct jobs at the Belfort facility

- Thousands more positions with suppliers across France

- Renewed investment in nuclear engineering capabilities

- Enhanced credibility for future international bids

- Strengthened partnerships with American nuclear companies

More importantly, the contract demonstrates that the nuclear supply chain can still adapt and compete. European companies had been written off by many analysts who assumed Asian manufacturers would dominate future nuclear construction.

Real-World Impact on Workers and Communities

In Belfort, the change is already visible. The town of 50,000 has watched its industrial base shrink for decades as traditional manufacturing moved elsewhere. This nuclear contract is reversing that trend in dramatic fashion.

Local suppliers are hiring again. Engineering firms that had downsized are expanding their teams. Technical schools are seeing renewed interest in nuclear-related programs.

“My son was planning to move to Germany for work,” says longtime Belfort resident Anne-Marie Rousseau. “Now he’s considering staying to work on these turbines. It feels like the town has hope again.”

The contract’s timeline spans nearly a decade, providing the kind of long-term stability that heavy industry needs to thrive. Workers can plan careers, suppliers can invest in equipment, and communities can count on sustained economic activity.

Beyond France, the deal sends a powerful message to other European countries considering nuclear power. It proves that a robust nuclear supply chain still exists in Europe, capable of supporting new construction projects.

“This contract changes the conversation about nuclear power in Europe,” notes energy policy expert Dr. Emma Richardson. “Countries that were hesitant about nuclear because of supply chain concerns now see there are viable European options.”

The timing couldn’t be better. As Europe seeks energy independence from Russian fossil fuels, nuclear power is experiencing renewed political support. France’s success with this Polish contract could position European companies for additional projects across the continent.

Several European nations, including Czech Republic, Romania, and potentially others, are evaluating new nuclear construction. The Arabelle win at Lubiatowo provides a compelling case study for choosing European suppliers over international competitors.

FAQs

What exactly is Arabelle Solutions providing to Poland’s nuclear plant?

Arabelle will supply three complete steam turbine islands, including turbines, generators, condensers, and auxiliary systems that convert nuclear-generated steam into electricity.

How much is this contract worth?

While no official figure has been released, industry experts estimate the contract value between €1 billion and €2 billion, with most analysts placing it around €1.5 billion.

When will these turbines be operational?

The first units are scheduled to come online from 2033 onwards, with all three turbines expected to be operational by the mid-2030s.

Why is this contract significant for Europe’s nuclear industry?

It marks a major comeback for European nuclear suppliers who had been losing market share to Asian and American competitors, proving European companies can still compete globally.

How many jobs will this create in France?

The contract will support over 1,000 direct jobs at the Belfort facility and thousands more positions throughout the French supply chain over the project’s duration.

Could this lead to more nuclear contracts for French companies?

Yes, the success of this project could position French suppliers for additional nuclear projects across Europe as countries seek energy independence and carbon reduction.