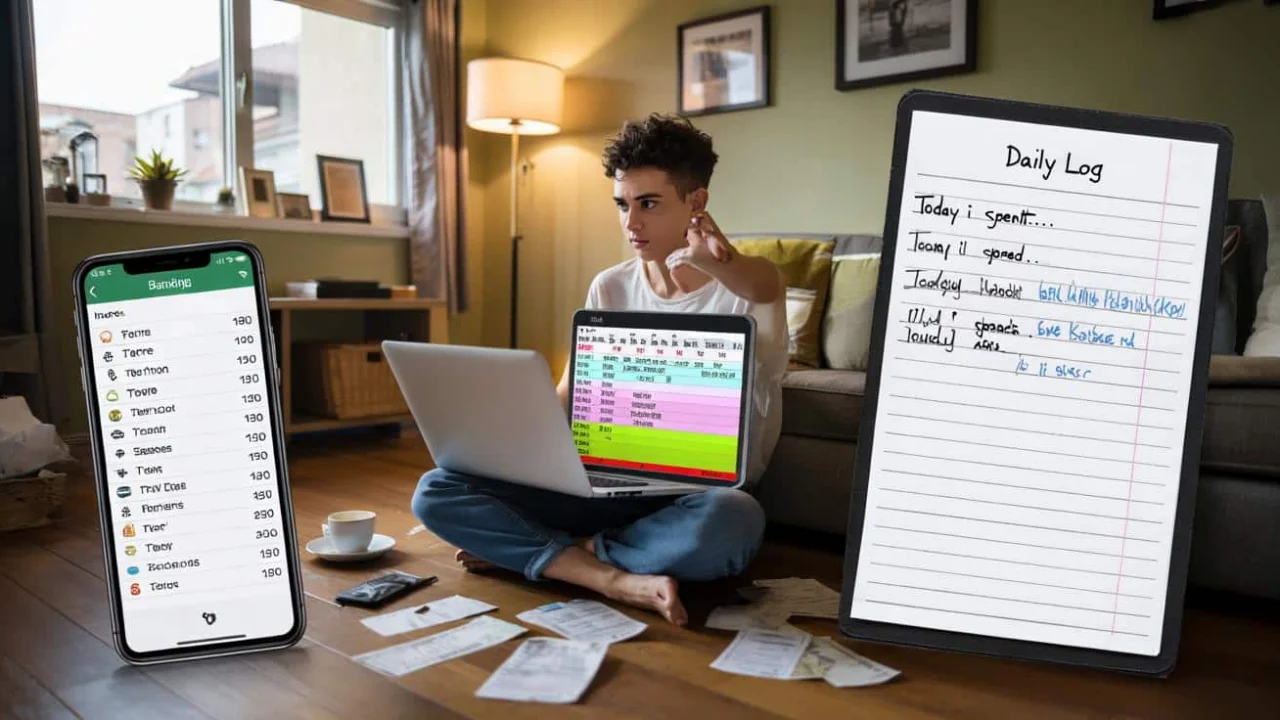

I stood in my kitchen at 2 AM, staring at my banking app like it held the secrets of the universe. The numbers didn’t add up. Again. Three weeks into the month, and my carefully planned budget had somehow evaporated into thin air.

Sound familiar? You start the month with the best intentions, color-coding spreadsheets and promising yourself this time will be different. Yet by week three, you’re wondering where all your money went, scrolling through transactions that feel like someone else’s life.

After years of this exhausting cycle, I finally cracked the code. The problem wasn’t my willpower or some mysterious money curse. It was something much simpler and more fixable than I ever imagined.

The Week Three Phenomenon: When Budgets Quietly Collapse

Budget management isn’t just about creating a plan—it’s about understanding why that plan falls apart. Week three has become the graveyard of good intentions, and there’s a psychological reason for it.

Week one feels powerful. You’re fresh off payday, armed with a new budget, and genuinely excited about your financial goals. Every purchase gets scrutinized. You pack lunches, skip the coffee shop, and feel like a budgeting superhero.

Week two brings the first cracks. A friend’s birthday dinner here, a forgotten subscription charge there. You start making small exceptions, but the budget structure still holds. You tell yourself these are one-offs.

“Most people experience what I call ‘budget fatigue’ around the third week,” explains financial counselor Sarah Mitchell. “Your mental energy for tracking every dollar is depleted, but you’re not quite desperate enough to pay attention again.”

Week three is where the magic happens—and by magic, I mean disaster. This is when your brain stops treating small purchases as real money. That $4 coffee becomes invisible. The $15 impulse buy at checkout doesn’t register. The convenience store snacks slip under your mental radar.

The Small Leak Problem: Why Tiny Purchases Sink Big Budgets

When I finally tracked my week-three spending honestly, the results were shocking. Here’s what one typical third week looked like:

| Purchase | Amount | My Justification |

|---|---|---|

| Morning coffee | $4.50 | “I’m tired, just this once” |

| Lunch delivery | $18.00 | “I forgot to prep meals” |

| Taxi home | $12.00 | “It’s raining” |

| Online app upgrade | $9.99 | “It’s only ten dollars” |

| Impulse snacks | $8.50 | “I deserve a treat” |

| Last-minute grocery items | $15.00 | “We need these tonight” |

Daily total: $67.99. Weekly total: $475.93. Monthly impact: over $1,900.

None of these purchases felt significant in the moment. Each one seemed reasonable, even necessary. But together, they consumed nearly 40% of my take-home pay.

The problem with small leaks is they’re psychologically invisible. Your brain doesn’t sound the alarm for a $5 purchase the way it would for a $500 one. But twenty $5 purchases add up to the same financial impact.

“Small, frequent expenses are budget killers because they fall below our psychological spending threshold,” notes behavioral economist Dr. James Rodriguez. “We literally don’t ‘see’ them as real money.”

The Psychology Behind Week Three Failures

Understanding why week three derails budget management comes down to three psychological factors:

- Decision Fatigue: By week three, you’ve made hundreds of financial micro-decisions. Your brain is tired of saying no.

- Rationalization Creep: Small exceptions become normal. “Just this once” becomes “just this week.”

- Delayed Consequences: The pain of overspending won’t hit until week four, so week three feels consequence-free.

- The Planning Fallacy: You consistently underestimate how much those “little things” will cost over time.

This isn’t about willpower or moral failing. It’s about how human psychology interacts with modern spending opportunities. Your brain simply wasn’t designed to resist the constant micro-temptations of digital payments and instant gratification.

Real People, Real Impact: Who Gets Hit Hardest

The week-three budget collapse affects different groups in predictable ways:

Young Professionals often struggle with convenience spending. Long work hours make expensive shortcuts feel justified. Coffee shops, food delivery, and ride shares become daily habits that destroy carefully planned budgets.

Parents face the “kid emergency” factor. School trips, forgotten supplies, and “everyone else is doing it” purchases pile up. One mom told me, “I budgeted for back-to-school clothes but forgot about the class party contributions, book fair money, and field trip fees.”

Commuters get hit with transportation creep. The planned train ticket becomes an expensive taxi when you’re running late. Parking fees multiply when your usual spot is full. Gas station snacks become routine.

“The impact goes beyond just money,” explains financial therapist Lisa Chen. “People feel like failures when their budgets collapse repeatedly. They stop trusting themselves with money, which makes the problem worse.”

The Solution: Strategic Budget Management That Actually Works

After recognizing my week-three pattern, I developed a system that addresses the psychology instead of fighting it:

The 80/20 Rule: I budget 80% of my money strictly and leave 20% for “life happens” spending. This removes the guilt from small purchases while protecting the majority of my income.

Weekly Check-ins: Every Wednesday, I review where I stand. This catches problems before they become disasters and resets my awareness.

The Five-Dollar Rule: Any purchase under five dollars gets tracked but not stressed about. Anything over gets a 24-hour waiting period.

Convenience Fund: I budget specifically for convenience purchases—coffee, taxis, food delivery. When it’s gone, I switch to planned alternatives.

The key insight? Stop trying to eliminate small spending entirely. Instead, acknowledge it exists and plan for it. Budget management works better when it aligns with human behavior rather than fighting it.

FAQs

Why do budgets consistently fail in week three specifically?

Week three hits the sweet spot where you’re mentally fatigued from budgeting but not yet feeling the financial pressure of month-end. Your psychological defenses are down.

How much should I budget for small, unexpected expenses?

Most financial experts recommend 10-15% of your income for miscellaneous spending, but I’ve found 20% works better for most people starting out.

Should I track every small purchase?

Track everything for one month to understand your patterns, then focus on purchases over $5-10. Tracking tiny amounts forever leads to budget burnout.

What’s the biggest mistake people make with budget management?

Assuming they’ll have perfect willpower every day. Successful budgets account for human psychology and build in flexibility from the start.

How can I prevent convenience spending from destroying my budget?

Create a separate “convenience fund” for coffee, ride shares, and impulse purchases. When it’s empty, you naturally shift to your planned alternatives.

Is it normal to feel like a failure when budgets don’t work?

Absolutely normal, but completely wrong. Budget failure usually indicates a planning problem, not a personal problem. The solution is better systems, not more willpower.